-

See the Difference: Save $1,000 on LASIK , Find More

*Must mention this promotion and be treated before April 30 of 2025 to qualify. $1,000 off for both eyes on standard Wavelight price, $500 off for one eye. Cannot be combined with any other offers.

HSA vs. FSA: Navigating Your Options for LASIK and Eligible Expenses

What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged savings tool designed for individuals enrolled in high-deductible health plans (HDHPs). It allows participants to set aside pre-tax dollars to pay for qualified medical expenses, offering a way to save on healthcare costs. HSAs are distinct because they offer tax-free contributions, tax-free growth, and tax-free withdrawals when used for eligible expenses, making them a smart choice for both short- and long-term health savings.

Key Benefits of an HSA

- Eligibility: Only available to those enrolled in a high-deductible health plan. HDHPs have higher deductibles and lower premiums compared to traditional health insurance plans.

- Triple Tax Advantage: Contributions are made with pre-tax income, the funds grow tax-free, and withdrawals for eligible medical expenses are not taxed.

- Rollover Feature: Unlike Flexible Spending Accounts (FSAs)Use FSA or HSA to Pay for LASIK or PRK, any remaining funds in an HSA roll over to the next year, enabling long-term savings.

- Portability: HSAs remain with the account holder, even if they switch jobs or retire, providing ongoing access to accumulated funds.

Using HSA Funds for LASIK

One of the benefits of having an HSA is the ability to use pre-tax dollars to cover LASIK surgery. Since LASIK is considered an eligible medical expense, you can pay for the procedure with HSA funds, reducing your taxable income and overall cost. Other eligible HSA expenses include:

- Prescription medications

- Doctor consultations and medical treatments

- Corrective lenses (contacts and glasses)

- Dental care

What is a Flexible Spending Account (FSA)?

A Flexible Spending Account (FSA) is a pre-tax savings account offered by employers that allows employees to pay for certain medical, dental, and vision expenses. With an FSA, you can save on out-of-pocket costs by using pre-tax income, effectively lowering your taxable earnings. However, FSAs differ from HSAs in terms of eligibility requirements, rollover capabilities, and overall flexibility.

Key Features of an FSA

- Eligibility: FSAs are generally available to employees through their employer’s benefits program, with no specific health plan requirements.

- Tax Savings: Contributions are deducted from your salary before taxes, helping to reduce your taxable income. Withdrawals for qualified expenses are also tax-free.

- “Use-It-or-Lose-It” Policy: Funds in an FSA must be spent within the plan year, or they are forfeited. Some employers may offer a grace period or allow a small amount to be carried over to the following year.

- Employer Contributions: Employers can choose to contribute to employees’ FSAs, but it is not a mandatory feature.

Covering LASIK with FSA Funds

LASIK surgery is often listed as a qualified expense under most FSA plans, making it possible to use pre-tax funds to cover the cost. This can make a significant financial difference, as you are effectively using income that would otherwise be taxed. Additional FSA-eligible expenses include:

- Medical deductibles and copays

- Prescription drugs

- Dental services

- Vision care, including contact lenses and eyeglasses

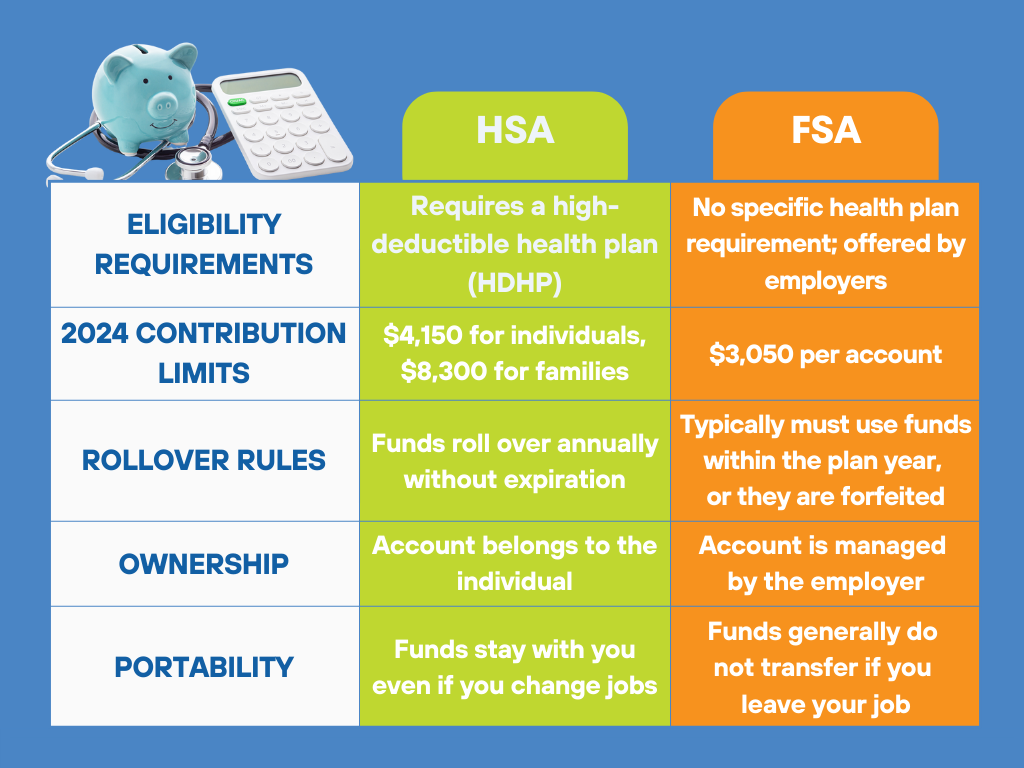

Comparing HSAs and FSAs

When deciding between an HSA and an FSA, it’s important to understand how each account functions and which features align with your healthcare and financial needs. Below is a comparison of the two:

Choosing the Best Option for LASIK Surgery

For those considering LASIK, both HSAs and FSAs offer advantages, but the decision may hinge on factors such as your health insurance plan, how you prefer to save, and your financial strategy.

- HSA Benefits: An HSA is ideal for those who want to save for LASIK over time. Because funds roll over, you can accumulate savings gradually, making it easier to afford the procedure without significant upfront costs.

- FSA Benefits: An FSA works well if you have a set timeframe in mind for your LASIK procedure. By allocating pre-tax dollars for the procedure, you can cover the cost without affecting your post-tax income.

Strategies for Saving on LASIK with HSA and FSA

Both types of accounts provide tax benefits that can help make LASIK more affordable. Consider these strategies to maximize your savings:

- Plan Ahead: If you are scheduling LASIK for the following year, adjust your HSA or FSA contributions during your benefits enrollment period to ensure you have sufficient funds set aside.

- Verify Coverage: Double-check that your LASIK provider accepts HSA or FSA payments, and confirm that the procedure qualifies under your plan’s guidelines.

- Optimize Tax Savings: By using pre-tax dollars, you can effectively lower the cost of LASIK, making it a more affordable investment in your vision.

Navigating HSAs and FSAs can seem complex, but understanding their differences can significantly aid in your healthcare planning. Both options provide a means to save on out-of-pocket expenses, including LASIK, by leveraging tax benefits. Whether you choose an HSA or an FSA, careful planning can help make LASIK more affordable, allowing you to achieve better vision while taking advantage of potential tax savings.

Resources:

U.S. Internal Revenue Service. (2024). Health Savings Accounts. Retrieved from https://www.irs.gov

U.S. Internal Revenue Service. (2024). Flexible Spending Accounts. Retrieved from https://www.irs.gov

U.S. Department of Health and Human Services. (2024). Understanding High-Deductible Health Plans. Retrieved from https://www.hhs.gov

YOU MIGHT ALSO LIKE...

VISION CENTERS NEAR ME

Enter your zip code, city, or a doctor name below to find a vision center.

Find out if LASIK is right for you

Congratulations!

Your vision issues can most likely be corrected with a LASIK procedure. Schedule a free consultation today.

Answer 5 simple questions to see if you are a candidate

What is your age group?

Do you wear...

With corrective lenses, do you have...

Have you ever been told that you have astigmatism?

Have you ever been told that you have dry eyes?

Request an Information Kit

Learn about your surgeon, the latest advanced technology, procedures, options and benefits, financing options, and what to expect from your LASIKPlus experience.